At least every three years, your Corporation is required to update your reserve fund study. Each update presents an opportunity to better align your plan with how your building or complex is performing, and adjust contributions to save enough for major projects.

With a volatile restoration construction pricing environment like the one we are in, which has been exacerbated by the COVID-19 pandemic, it can be very challenging to predict how much you need to save for upcoming projects. Does your roof replacement cost the same as it would have three years ago? What about your window replacement project looming in the next 10 years? What does your crystal ball say?

We will explore how to identify risks that your condominium may not be saving enough. By understanding Reserve Fund Studies, you can better recognise some red flags in your plan, and how to get back on track.

Risks of a Reserve Fund

Reserve Fund Studies are required by the Condominium Act every three years. Their purpose is to collect funds to pay for major projects and ensure the physical and financial assets of the corporation stay in balance.

Determining the amount of risk in a Reserve Fund Study is more complex than just looking at the lowest balance in the next 30 years. The timing, phasing and budgets of major projects should be considered to ensure there is enough resilience built into the study. Budgets should be put under a microscope, especially for major restoration projects or expenditures in the short term. How accurate are your budgets? Do they include a sufficient contingency amount? Is further review needed to better determine options and budgets? If construction inflation continues to outpace the inflation estimate in your study, can you still afford new windows in 10 years?

Understanding the building components that are driving contributions is critical to understanding the impacts on your study. Contribution amounts and fund balances need to be adequate to fund current and future projects.

How Close Can We Cut It?

There are many ways to set your funding plan, which will vary depending on your reserve fund planner. A common strategy is the "minimum balance" approach. In this approach, the reserve fund planner establishes how low balances can get in the next 30 years. This can offer a reasonable starting point but may not tell the whole story. Low balances following major repair projects can increase the risk of inadequate funds if budgets or timing changes. While most larger budgets should include contingencies, projects beyond the short term may also be disproportionately impacted by rising construction inflation. For example, the future cost of a project will be inflated by your reserve fund planner, typically at a lower rate than recent construction inflation. In the short term the impact is minimal. Long term, the impact can be significant if this trend continues. Contingencies are intended to capture unforeseen costs, such as concealed conditions that impact the project budget, often calculated as a percentage of the total project cost. This "buffer" will shrink for future projects if construction inflation continues to outpace the reserve fund planner's assumptions.

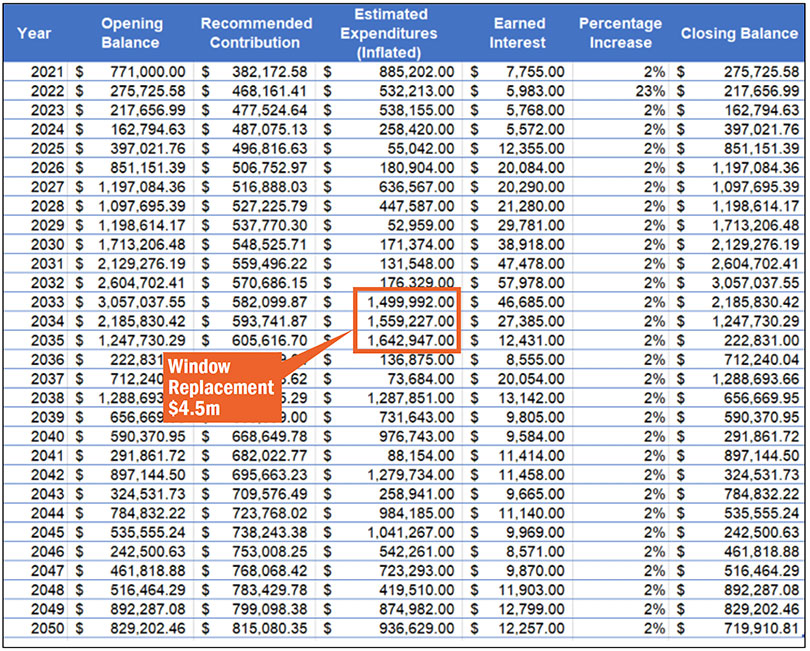

Consider a sample Cash Flow Table that has a low balance of just over $200k following a $4.5m window replacement project.

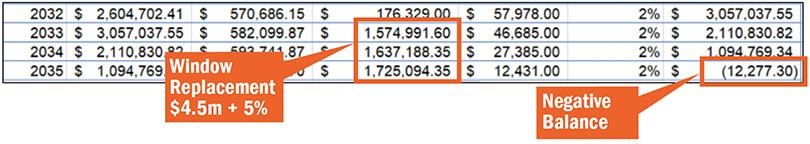

The project is planned to be phased over three years; the Corporation is planning to have just over $3M leading up to the project and is contributing nearly $1.8M to the Reserve Fund during the project. No problem, right? Not exactly. In this scenario, consider what the balances look like if the project costs just 5% more than the RFS budget.

With a 5% increase in the project budget, the Corporation has negative balances and cannot fund the project with the current plan. Fluctuations of this magnitude are not uncommon for a project of this scale especially as construction inflation remains high. Careful consideration is needed to prepare for the future.

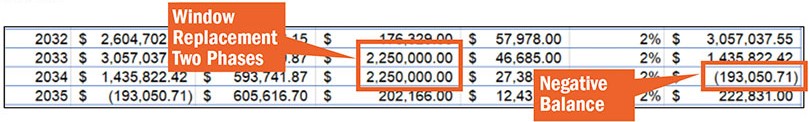

Next, we will look at the original budgets again, but instead of phasing the project over three years, the Corporation decides to complete the project over just two years to minimize the disruption to owners. Again, similar to the increased budgets, this scenario results in negative fund balances and the Corporation cannot afford the project.

A better approach is to measure fund balances relative to planned expenditures over a few years. When planned expenditures are roughly equal to starting balances then the study becomes risky. You are living year to year and annual contributions are providing the buffer. This can lead to a Corporation being underfunded or deferring projects if project costs are higher than anticipated or if projects happen sooner than planned. The timing of projects within a fiscal year can also increase the risk. For example, a Corporation with an April fiscal year end is spending reserve money for weather-sensitive projects at the very start of the fiscal year in the spring and summer.

How Can I Predict the Future?

There are several assumptions that are built into a Reserve Fund Study, such as long-term interest and inflation rates and cost estimates. Many engineers will gather information from their building restoration teams to maintain an internal cost database as projects are tendered. Building type, height, access, and geographic location are typically considered to show realistic "today's dollars" cost estimates. Unless the work has been tendered to contractors and there are contracts in place, cost estimates in your reserve fund study are only budgets to help guide your funding plan. In the restoration construction industry, year over year cost increases continue to outpace Consumer Price Index (CPI) inflation. Costs of materials and labour are increasing across the industry, driving up contractor pricing.

While the future is unknown, there are a few areas that need attention to ensure your RFS is resilient:

- Realistic project phasing: Does it make sense for your window replacement project to be phased over six (or fourteen!) years? What happens if this project happens over two or three years? What impact does this have on your funding plan and other planned projects?

- Interest and Inflation Rates: Does the assumed interest rate match your actual interest collected? In the recent past we have seen inflation rates higher than interest rates. Unrealistic interest assumptions can result in inflated fund balances.

- Realistic project costs: Unit pricing for projects is not a "one size fits all" approach. There are many factors that impact project costs, including:

a. Access: Does your roof have enough roof anchors? Are there many small roof areas, or one big area? How tall is your building? How will new mechanical equipment be installed?

b. Location: Projects in densely populated areas (i.e., Toronto) can be challenging for project staging and material storage. Roof replacement on a single-storey commercial building will cost significantly less than on a high-rise tower in downtown Toronto.

Ultimately, the risk you are trying to avoid is not having enough funds to maintain the building or complex as planned. If the Corporation is underfunded, changes to the funding plan are needed. In some cases, increases in annual contributions over a short time period can be used to "ramp up" funds to plan for future projects. Occasionally, this is not sufficient. Enter Special Assessments…

We Need to Talk About Special Assessments

With all this talk about contribution increases and risk management, most Corporations are trying to accomplish two things:

- Avoid the investment-inefficient scenario of being overfunded; and

- Avoid Special Assessments and smooth out contribution increases.

For the first item, we have rarely seen this. Corporations simply are not turning to their engineer and asking for higher contribution increases, then ending up with too much money. When additional funds do get added, they are often quickly spent. The second item is one we hesitate to even write about because of the negative connotations associated with special assessments. Poor planning. Previous Board's fault. Unpopular. Stressful. Punishing current Owners. Giving future Owners a break.

When faced with levying a special assessment, some Boards will choose to defer major repairs or implement band-aid solutions against their engineer's recommendation. These strategies can perpetuate a false sense of security among owners who are not fully informed and do not understand the associated risks. In many cases this approach will do more harm than good. At worst, projects are not just deferred – they are ignored. If a deferral strategy is going to work, the project still needs to be planned for in the future, which typically means you still need to save more today.

Risk of unforeseen items and concealed conditions that lead to special assessments is best mitigated by carrying out Condition Assessments. This is where your engineer will evaluate options and timing for repair or replacement of a specific building component of concern, then update your Reserve Fund Study.

The condominium lending industry has also dramatically improved its offerings in recent years, and Boards owe their owners the due diligence of considering all options including loans. Engaging your community in the discussion and providing a forum for input is the best path for any Corporation facing a shortfall.

Forget the Crystal Ball

Since Reserve Fund Studies are updated every three years, major market changes are gradually corrected at each update for projects planned over the long-term. Boards would be wise to expect adjustments at each update to incorporate these market changes.

We encourage Boards to ask about risk and assess how sensitive the study is to changing assumptions. At a minimum, Boards should check planned fund balances around the time of major projects. Edison is a communication-focused professional engineering and project management firm specializing in the repair and restoration of existing buildings. Over 60% of our services are for Condominiums. We specialize in Restoration work and leverage that knowledge and experience to help our clients develop repair plans and Reserve Fund Studies aligned to their objectives and financial constraints.